MAKING A LIST AND CHECKING IT TWICE: TEN ACTIONS TO PREPARE FOR A HEALTHY NEW YEAR

Garry Bartecki, financial advisor to the equipment industry and founder of Dealer-Rental Success LLC, recently shared with dealers his go-to assessment checklist of assets, people and data to take the guesswork out of planning for 2015. This list is excerpted from his article published in the December issue of Construction Equipment Dealer magazine. By keeping regular track of all the items on the list using ASPEN, running these reports should be a breeze.

We’ve included some tips on how to achieve some of the items on the list using the ASPEN dealership management system.

- Make sure you understand 2014’s results and any non-recurring transactions in ‘14 that will not repeat in ‘15.

- Spend time with department heads to get their thoughts on 2015. You may also want to chat with some line folks to get their input as well.

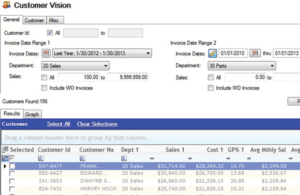

- You personally should visit the customers that provide 80 percent of your revenue. That should work out to be the top 20 percent of the customer list. Run a report listing 2014 customer revenue to date and go from there. In fact, run a three-year comparison of that report to see who has made the list and who fell off the list.

TIP- Use ASPEN’s Customer Vision Screens to pinpoint your top customers. Log your visits in your customer records using ASPEN’s CRM.

4. Review your credit and collection policies and update as necessary.

5. Get a receivable list and go over it line by line to find out what all those strange numbers mean. There are probably some bucks available on the list you should get, or there may be customers on the list who should no longer be there. Believe me, an aggressive credit and collection policy pays for itself, saves a lot of time, and keeps cash in the bank account.

6. I hate to do this: Get both parts and a new and used inventory list (including a work-in-process list). Now let’s see how much cash we have tied up in old parts and junk. While you’re at it, check your turnover for all inventory accounts and compare that to the CODB as well.

7. Ask your HR department for an active employee list and compare those employees who generate income against those who don’t. Ask your peers to prepare a similar list so you can compare results. Calculate that percentage of income producers as a percentage of total staff and use that calculation to see if you are overstaffed because procedures are out of date or the system is not being utilized properly.

TIP- Use ASPEN’s Sales/Gross Profit by Salesperson report to get started.

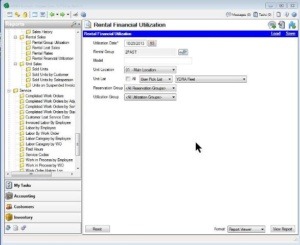

8. I assume you’re in the rental business in some shape or form. If so, get a list of rental equipment along with time and dollar utilization figures for each rental unit. Use the list to see what goes, what stays, and what gets added to the fleet for 2015. And remember, you have to look at RTS and RTR categories separately. Rental is a risky business in terms of cash management, so make sure you know what you are doing in this area.

TIP- Use ASPEN’s Financial Utilization reporting to determine what stays and goes in and out of your fleet.

9. Ask your CFO for a cash flow statement similar to the one you find in your annual audit report. How are we doing? There are three sections in that report: operations, investing and financing. Are you making money from operations or just because you are selling off assets?

10. Finally, go through your individual departments for the last three years and also compare the results against the CODB numbers. There’s money in that data – yours for the taking. I would make this a quarterly function because if folks know you are looking things have a way of getting cleaned up before you see it. It’s magic.

GARRY BARTECKI (gbartecki@comcast.net), founder of Dealer-Rental Success LLC, is a financial consultant to the equipment industry and is not affiliated with Charter Software Inc. He can be reached at 708-347-9109.