Service work is a huge part of your dealership’s business and can be extremely profitable. Unfortunately, many dealers are faced with the difficult situation of having to deal with customers who can’t or won’t pay for services rendered.

Service work is a huge part of your dealership’s business and can be extremely profitable. Unfortunately, many dealers are faced with the difficult situation of having to deal with customers who can’t or won’t pay for services rendered.

Understanding your collection options and some advance planning can increase the chances of collecting on delinquent service invoices.

Dealers usually have legal rights to help get paid without the need for a lawsuit, but by neglecting to plan for these situations, they can miss opportunities to take advantage of their legal rights. For example, by including terms in repair authorization forms, dealers stand a better chance of recovering payment in these situations.

Often times, these situations require you to make tough decisions. For example, should you hold on to the equipment for leverage, or try to sell it to recoup your costs?

The value of the equipment and the amount of the repair bill will help to make this decision.

Hold onto the equipment. Most states allow dealers to keep the equipment until payment is received, which greatly increases the chances of that happening. Understanding your state repair lien laws will help you make decisions about how to handle non-payment situations. In some states, dealers can keep a lien if they release the equipment.

This gives you more flexibility to give equipment back to the customer before getting paid, but may have some limitations:

- Dealers may have to make a filing with the government (similar to a UCC filing) within a certain period of time.

- Required language may be needed in your repair authorization form.

- Releasing the equipment might put you behind the bank’s security interest.

Sell the equipment. Many states give you the right to sell the equipment and use the proceeds to cover your repair bill. This process can vary significantly between states and can have some restrictions. Know if your law gives you priority over other liens against the equipment.

Dealers can also try to avoid the situation altogether by using preventative measures, specifically by including terms of service on your quotes and invoices:

- Require a Security Interest. A security interest can cover your repair bill, costs of sale, attorneys’ fees, etc. Even if you don’t do a UCC filing, a security interest will give you a right to repossess the equipment and create leverage to get paid.

- Add Storage Charges. Adding a storage charge that applies after the work is complete will help you deal with customers leaving seasonal equipment on your lot for months at a time (while not paying the repair bill).

- Indicate finance charges on the service contract.

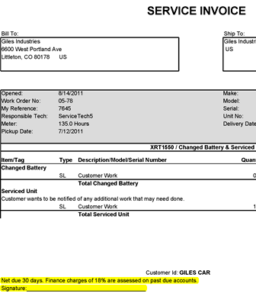

Including custom text to your service contact as shown in ASPEN, left, can deter customers from delinquency and offer your dealership additional protection. ASPEN Business Management Software allows you to add this information to the service invoice: